Have you heard about tokenomics?

It can be really difficult to pick from the tens of thousands of available cryptocurrencies when trying to invest. Many of them look promising from afar and may have a lot of social media buzz surrounding them; but deep down, they are just empty shells.

So, the question is: How Can You Make the Best Analysis of a Cryptocurrency before investing?

The answer is Tokenomics!

What is Tokenomics?: Crypto Analysis 101

Tokenomics of a crypto asset or Token Economics is a robust collection of information about a crypto asset mostly revolving around underlying economic principles and mechanisms that govern the distribution, and valuation of these cryptocurrencies.

Tokenomics can tell a lot about a crypto asset’s functionality, objective, scalability, and much more. Such factors are key to discovering assets that you are comfortable with and align with your risk tolerance and overall profit goals.

Now, Tokenomics is mostly represented by the following metrics:

-Token Supply

-Market Capitalization

-Token Distribution & Allocation

-Project Utility

and more…

Let’s further dive into a few of these metrics to learn what they are and then see how they can influence our decisions when investing.

Token Supply

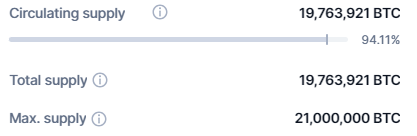

Every cryptocurrency has three types of token supply: The Circulating supply, the Total Supply, and the Maximum Supply.

Circulating Supply of a cryptocurrency is an indicator of how many tokens are currently in public circulation and actively being used and traded worldwide. You can think about it like the number of publicly available shares of a stock that can be traded at any time.

Total Supply on the other hand includes the circulating supply plus any more of the tokens that were burned off.

Note: Burning tokens is a mechanism to create scarcity of a cryptocurrency by actively removing a portion from ever being publicly accessible. However, not all tokens have this feature.

Finally, Maximum Supply. This tells us the maximum number of tokens that will ever exist in the lifetime of that cryptocurrency. For example, Bitcoin is popularly known to have a total of 21 million coins that can ever be mined.

21 million in this case is the maximum supply of Bitcoin. Having this fixed value makes it a deflationary currency. Ethereum on the other hand has no maximum supply making it inflationary.

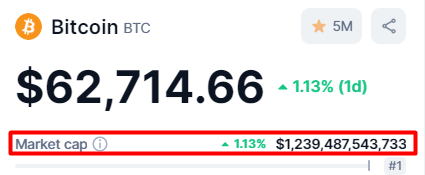

Market Capitalization

Market Capitalization or Market Cap represents just how much money has been invested into a cryptocurrency. It is calculated by the current token price multiplied by the circulating supply.

Usually, tokens are ranked based on market caps as this metric represents the interest of the public in the asset. Bigger market cap coins rank higher than smaller market cap coins.

This particular metric offers very good insight for investments, and we will discuss how soon enough…

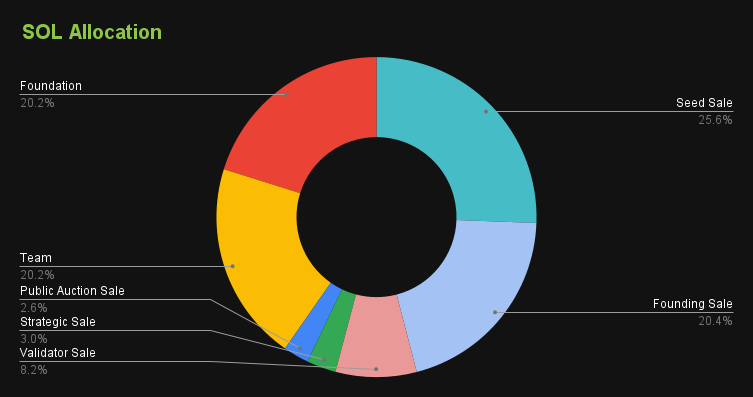

Token Allocation & Distribution

At the starting moments of any cryptocurrency, there is always an allocation of the token supply to different facets of the ecosystem.

Some tokens could be allocated to the early investors such as venture capitalists that were pivotal to the successful launch of the project.

Some of the supply could also be allocated to community incentives to keep the core believers in the project actively engaged and happy with rewards for the foreseeable future.

Then there’s the public supply, which is tradeable by anyone.

Sometimes, you might even see the core team members have an allocation of their own.

There are an unlimited number of ways the allocations can go, and it all depends on the founders of the cryptocurrency or in some cases, the community can be involved in that decision-making.

How Do These Metrics Influence Potential Investment Decisions?

Let’s start with the token allocation…

Projects that have a large number of tokens allocated to the core team or investors are usually not perceived very favorably by the public and tend to do poorly overall.

This is because the investors and team members who are looking to turn a profit on their hard work and investment will almost definitely sell off their allocation for profits. This contributes to heavy sell pressure on the retail crypto buyers, heavily dumping the price of the asset and serving as a red flag to the public eye.

On the other hand, projects with more supply allocated to the public or community are received very well and viewed as heroes of the people who keep their community in mind and of the highest priority. Such projects face way less sell pressure since there are no big players to actively dump the price and these kinds of projects tend to garner long-term support and longevity.

Then what about market capitalization? When looking out for coins to invest in, it might be worth looking for promising projects with good utility that are still low in market cap.

This is because the lower the market cap, the more room for growth there is if the project begins to perform very well. However, assets with really high market caps can only go so much higher as their token prices are increasingly unaffordable, and little room to scale.

And finally, the token supply. While this isn’t always the case, deflationary tokens are usually viewed more favorably than inflationary ones.

After all, the whole essence of crypto was to combat inflation in the first place. This is why we see tokens like Litecoin and Bitcoin still holding the top spots amongst the thousands of tokens on the market.

Conclusion

Before picking any crypto assets to invest in, it’s almost paramount to check the tokenomics and review some of these important details before making a decision.

Some tokens have very bad tokenomics that are almost certain to cause loss eventually. Always feel free to join the socials to any cryptocurrency you are interested in and ask questions about their tokenomics.

It’s the due diligence you need to do to not get rekt.