Popular Cryptocurrencies have become a global phenomenon, with thousands of digital currencies available. But not all cryptocurrencies are worth your attention. With the crypto market rapidly expanding, it’s important to focus on the most significant players—those that stand out not only for their market value but also for their community support and backing from major companies. In this guide, we’ll explore the most popular cryptocurrencies, why they’ve become dominant, and what to consider when investing in them.

Bitcoin and Ethereum: Most popular cryptocurrencies

Any discussion about popular cryptocurrencies has to start with Bitcoin and Ethereum. These two digital currencies are considered the pillars of the cryptocurrency market.

Bitcoin (BTC)

Bitcoin is not just a cryptocurrency—it’s the original cryptocurrency. Launched in 2009 by an anonymous person or group known as Satoshi Nakamoto, Bitcoin paved the way for decentralized finance. Its purpose is simple: to offer a peer-to-peer system for payments without the need for intermediaries like banks. Bitcoin’s market capitalization has consistently made it the most valuable cryptocurrency, and it is often seen as “digital gold” due to its limited supply of 21 million coins.

Bitcoin has gained the trust of investors thanks to its longevity and adoption by major companies. Even giants like Tesla have invested billions in Bitcoin, and many other firms, such as Microsoft, now accept Bitcoin payments. The sheer weight of support from these companies gives Bitcoin unparalleled credibility in the market.

Ethereum (ETH)

While Bitcoin is viewed as a store of value, Ethereum offers something more—smart contracts. This blockchain platform allows developers to build decentralized applications (dApps) on top of it, unlocking countless use cases from finance to gaming. Ethereum’s flexibility has made it the second most popular cryptocurrency by market capitalization.

Just like Bitcoin, Ethereum has received backing from influential companies. Platforms such as JP Morgan and Amazon Web Services (AWS) are leveraging Ethereum’s network for various blockchain projects, solidifying its role as the leading blockchain for more than just transactions.

Most Popular Cryptocurrency Exchanges

When it comes to buying, selling, or trading cryptocurrencies, selecting a reliable cryptocurrency exchange is essential. Here are some of the most popular exchanges that are trusted by millions of users worldwide:

- Dexifier is a Cross-Chain Decentralized Exchange.

Cross-Chain: We’re not stuck with a single chain. We can easily swam assets on Ethereum, to Solana, to Arbitrum, and back to Ethereum if we want.

We are DECENTRALiZED, which means built on top of decentralized platforms, meaning that it is censorship resistant (very hard for govs to shutdown). PERMISSIONLESS (anyone can use it, you don’t need permission from anyone). NO KYC, we don’t need to know who you are to use our DEX, we uphold privacy values.

2. Binance

Binance is currently the largest cryptocurrency exchange in the world by trading volume. It offers access to hundreds of cryptocurrencies, including all major ones like Bitcoin, Ethereum, and Solana. Binance is favored for its low fees, extensive range of trading pairs, and advanced trading features. Additionally, Binance has launched its own token, Binance Coin (BNB), which is used to reduce transaction fees on the platform.

3. Coinbase

Coinbase is a user-friendly exchange that caters to both beginners and experienced traders. It is one of the largest and most reputable exchanges, especially in the United States. Coinbase allows users to buy and sell a variety of cryptocurrencies, including Bitcoin, Ethereum, and many altcoins. Its secure platform and simple interface make it one of the most popular exchanges for people entering the world of crypto for the first time.

4. Kraken

Kraken is known for its robust security features and comprehensive range of cryptocurrencies. Founded in 2011, it is one of the oldest crypto exchanges still in operation today. Kraken provides a secure platform for trading major cryptocurrencies as well as a variety of lesser-known altcoins. The exchange also offers margin trading and staking options, making it a go-to for more advanced users.

5. Gemini

Gemini, founded by the Winklevoss twins, is another highly reputable cryptocurrency exchange, especially in the United States. Gemini places a strong emphasis on security and regulatory compliance, making it a trusted platform for institutional investors. It offers a wide range of cryptocurrencies and also supports interest-earning accounts for crypto holdings.

How Many Types of Cryptocurrencies Are There?

With the rise of cryptocurrencies, it’s important to understand that there are multiple types, each serving different purposes. Generally, cryptocurrencies can be divided into the following categories:

1. Payment Cryptocurrencies

These are digital currencies designed to serve as a medium of exchange, much like traditional money. The most notable example is Bitcoin, but others like Litecoin (LTC) and Bitcoin Cash (BCH) also fall into this category.

2. Utility Tokens

Utility tokens are cryptocurrencies used to access specific services within a blockchain ecosystem. Ethereum (ETH) and Binance Coin (BNB) are examples of utility tokens, allowing users to interact with decentralized applications (dApps) or pay for services within a platform.

3. Stablecoins

Stablecoins are pegged to the value of a stable asset like the US dollar. Examples include Tether (USDT) and USD Coin (USDC). These coins are used to maintain stable value in the otherwise volatile cryptocurrency market, making them ideal for day-to-day transactions.

4. Security Tokens

Security tokens represent ownership in an asset, much like traditional stocks. These tokens are used to raise capital in a way similar to issuing shares, and they are typically subject to regulation. Examples include tZERO and Polymath.

5. Governance Tokens

Governance tokens give holders the right to vote on changes and decisions within a decentralized blockchain network. Projects like Uniswap (UNI) and Compound (COMP) are examples of governance tokens, where the holders can participate in important decisions affecting the future of the platform.

Understanding the different types of popular cryptocurrencies can help investors make more informed decisions about which digital assets best fit their portfolio.

Feel free to check our article about why are so many cryptocurrencies.

Top Popular Cryptocurrencies Beyond Bitcoin: Solana, Cardano, and More

While Bitcoin and Ethereum dominate the market, several other cryptocurrencies have been gaining traction thanks to their innovative solutions and future potential. Some of these include:

Solana (SOL)

Solana is often dubbed as one of Ethereum’s main competitors due to its high-speed and low-cost transactions. It has quickly become a favorite among developers building decentralized apps and NFTs (non-fungible tokens). What sets Solana apart is its scalability, allowing thousands of transactions per second. This feature has caught the attention of institutional investors and major players in the tech world, positioning Solana as a top contender.

Cardano (ADA)

Cardano takes a research-first approach, aiming to create a highly secure and scalable blockchain. Founded by Charles Hoskinson, one of Ethereum’s co-founders, Cardano uses a proof-of-stake consensus mechanism, making it more energy-efficient than Bitcoin’s proof-of-work. Cardano has a solid roadmap and a strong community, which has given it a significant position in the top 10 cryptocurrencies by market cap.

Binance Coin (BNB)

Binance Coin is the native cryptocurrency of Binance, the largest cryptocurrency exchange in the world. BNB started as a utility token for trading on Binance but has since expanded its use cases, including paying transaction fees on the Binance Smart Chain. Binance Coin’s success is largely due to the immense growth of the Binance platform and its integration into various projects and decentralized finance (DeFi) protocols.

These cryptocurrencies, like Bitcoin and Ethereum, have the backing of large, enthusiastic communities and are supported by strong technical foundations. They are also gaining significant attention from investors looking for the next big thing in the crypto space.

The Importance of Market Capitalization and Community Support in Crypto Investments

When deciding which cryptocurrencies are worth investing in, one key factor is market capitalization—the total value of a cryptocurrency’s circulating supply. Higher market caps usually indicate more stability and investor confidence, making these assets less susceptible to the extreme volatility that plagues smaller, lesser-known coins.

Another critical aspect is community support. Cryptocurrencies like Bitcoin, Ethereum, and Solana have large, active communities that contribute to their development and ensure that the projects continue to grow. A strong community can make or break a cryptocurrency’s future, as it helps sustain the project and creates trust among new investors.

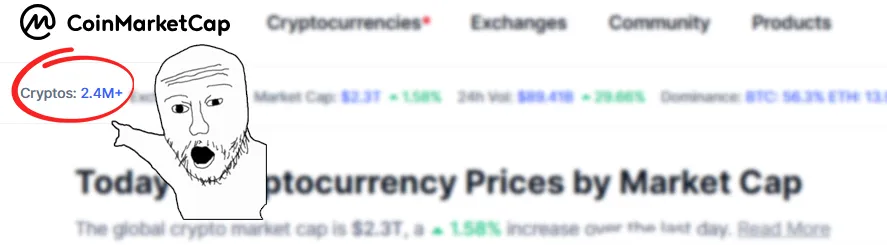

As you wisely pointed out from your experience, the top 10 cryptocurrencies listed on platforms like CoinMarketCap are typically the ones worth considering for long-term investments. These projects tend to have a solid foundation, both in terms of market capitalization and community backing, reducing the risk associated with their investments.

Anyways you have 65+ cryptos that you can check in our website

Best Popular Cryptocurrencies to Invest in 2025

Looking ahead to 2025, the future of cryptocurrency market is likely to continue evolving, and certain cryptocurrencies are poised to remain strong or grow even more. Here are some of the best digital assets to consider for long-term investment:

1. Bitcoin (BTC)

As the oldest and most established cryptocurrency, Bitcoin remains a solid investment option. Its deflationary nature, combined with increasing institutional adoption, makes it a likely candidate for continued growth, even as competition arises.

2. Ethereum (ETH)

Ethereum’s upcoming upgrades (including Ethereum 2.0) aim to improve scalability and reduce energy consumption, making it more attractive to both developers and investors. Ethereum’s role in powering decentralized finance (DeFi) and NFTs is expected to keep it at the forefront of the crypto world.

3. Solana (SOL)

Solana’s rapid rise, high throughput, and low fees make it a promising choice for future investors. With a strong developer ecosystem and growing institutional interest, Solana is seen as one of the most innovative projects in the space.

4. Cardano (ADA)

Cardano has consistently delivered on its promises of a secure and energy-efficient blockchain. Its research-based approach and strong community support ensure that it will continue to be a top contender in the years to come.

5. Polkadot (DOT)

Polkadot aims to facilitate interoperability between different blockchains, allowing for seamless data sharing and transactions across multiple networks. This unique proposition could become increasingly valuable as more blockchains are developed, making Polkadot a key player in the next phase of crypto growth.

As we move towards 2025, these cryptocurrencies are likely to offer strong long-term investment opportunities, especially for those seeking to invest in projects with solid foundations and innovative solutions.

How Big Companies Like Tesla and Microsoft Are Backing Crypto

One of the most significant trends in cryptocurrency over the last few years has been the growing involvement of large, traditional companies. Tesla, for example, has invested over $1 billion in Bitcoin, while Microsoft accepts Bitcoin payments for its products. Even PayPal has integrated crypto payments into its platform, allowing millions of users to buy, sell, and hold cryptocurrencies directly from their accounts.

This institutional interest provides a layer of legitimacy to the cryptocurrency market that wasn’t present in its early days. When major corporations put their trust (and funds) into digital assets, it encourages both retail and institutional investors to follow suit. It’s a clear signal that cryptocurrencies, particularly the well-established ones, are no longer seen as speculative bubbles but as genuine stores of value and mediums of exchange.

Why Focusing on Long-Term Crypto Projects is Key for Investors

While thousands of cryptocurrencies exist, only a few hold long-term potential. As you rightly observed in your experience, it’s important to segment cryptocurrencies based on their project longevity and market credibility. Short-term, speculative coins can offer quick returns, but they often come with high risks and uncertainty.

On the other hand, cryptocurrencies that have survived market downturns—like Bitcoin and Ethereum—are likely to remain strong. These projects often have the backing of major players, a clear use case, and are continuously being developed to improve their networks. This makes them ideal for investors with a long-term perspective.

How to identify a good crypto buy

So what should you do with thousands of cryptocurrencies available in the market, determining which ones are worth your investment can be a challenging task. Not every coin is destined for success, and the volatile nature of the crypto market means that due diligence is essential. Here’s a guide on how to identify a good cryptocurrency buy to help you make informed decisions and avoid potential pitfalls.

1. Market Capitalization and Liquidity

One of the first metrics to evaluate when considering a cryptocurrency is its market capitalization. Market cap reflects the total value of the coin’s circulating supply, calculated by multiplying the current price by the number of coins in circulation. A higher market cap generally suggests a more stable and widely adopted cryptocurrency, reducing the risks associated with extreme volatility.

Liquidity is also key—it refers to how easily you can buy or sell the cryptocurrency without affecting its price. If a cryptocurrency has low liquidity, it may be difficult to execute trades at your desired price, and you could end up losing value in the process. Cryptocurrencies like Bitcoin and Ethereum have high liquidity, making them safer options compared to lesser-known coins with lower trading volumes.

2. Strong Use Case and Utility

A cryptocurrency with a clear and valuable use case is more likely to stand the test of time. Some coins are designed for specific purposes, such as enabling smart contracts (like Ethereum) or improving transaction speeds (like Solana). When evaluating a cryptocurrency, consider its utility and whether there is a real-world problem it aims to solve.

Ask yourself:

- Does this cryptocurrency have a functional purpose beyond speculation?

- Is it part of a growing industry, like decentralized finance (DeFi) or non-fungible tokens (NFTs)?

- Is the technology innovative or an improvement over existing solutions?

Coins with a well-defined use case that provide unique value are more likely to gain long-term traction.

3. Development Team and Community Support

Behind every successful cryptocurrency is a dedicated development team and a strong community. Research the team responsible for building and maintaining the project. Are they experienced in blockchain technology? Do they have a track record of success in previous projects?

The community surrounding a cryptocurrency is just as important. Strong community support often leads to broader adoption and drives the project forward. Platforms like Reddit, Twitter, and Discord can give you insight into the community’s engagement, enthusiasm, and level of involvement in the project.

For example, projects like Bitcoin and Ethereum have large, active communities that contribute to their continuous development. A good crypto buy will typically have a visible and supportive community actively discussing improvements, partnerships, and future developments.

4. Roadmap and Transparency

A cryptocurrency with a clear roadmap is more likely to succeed. The roadmap lays out the future goals and milestones of the project, giving investors an idea of where the development is headed. Check if the project has consistently delivered on its promises or if there are delays and setbacks.

Transparency is another crucial factor. A reputable crypto project will regularly update investors and the community about its progress. You should be cautious of projects with vague goals or those that lack transparency about their technology or future plans.

5. Security and Technology

In the world of cryptocurrencies, security is non-negotiable. A good cryptocurrency buy will have a solid technological foundation that prioritizes security measures. Here are some questions to ask:

- Does the project use reliable consensus mechanisms, such as proof of work (Bitcoin) or proof of stake (Ethereum 2.0, Cardano)?

- Has the project been audited by third-party security firms?

- Are there known vulnerabilities or security incidents in its history?

Projects that take security seriously and consistently work to improve their technology are safer bets in the long term.

Conclusion: Choosing the Right Cryptocurrencies for Your Portfolio

In a sea of over 10,000 cryptocurrencies, focusing on the top projects is crucial for building a solid investment portfolio. The most popular cryptocurrencies—like Bitcoin, Ethereum, Solana, and others—stand out for their stability, large communities, and backing from reputable companies. As an investor, you need to segment these based on their market capitalizations, community strength, and future potential.

By investing in well-established projects, especially those with strong institutional support, you minimize risk while positioning yourself for long-term gains. Cryptocurrencies are here to stay, and by making smart, informed decisions, you can be part of the future of finance.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information.